Cott gets more than 30% of its revenue from the Walmart relationship (CSD, water, other beverages). Clearly a lot is at stake for Cott, which reported a $88 MM loss in its third quarter, coupled with a 9.5% decline in sales compared to last year. With only $21 MM of cash (Nov'08) and a debt/ equity ratio of 2.3, Cott is in a tight liquidity position, given that it had cash outflow of $17 MM in the first three quarters from operations and capex. Any decrease in Walmart business is likely to affect Cott significantly.

I stopped to think: Why would the world's largest retailer cancel its exclusivity clause for its fizz supplier (which has been a supplier for 10 years now)? What should Cott expect in terms of sourcing impact?

- Exclusive relationships are not common in the food & beverage market. Cott had managed to get an exclusivity clause in its agreement with Walmart in 2000 because Cott needed to make significant capex to support US domestic CSD supply to Walmart.

- Walmart may be creating the flexibility to source from other vendors, if Cott has sustained losses during the recession and may get operationally affected.

- Cott's conference call referred to Cott's extensive US domestic production facilities and its proprietary CSD formulas. It will be difficult for another vendor to replicate the exact taste of the Cott's products and to match the production facilities. As such, it will be difficult for Walmart to rapidly introduce a new CSD vendor with the same brand and different taste than their current product. Walmart may have to spend significantly to introduce new sub-brands in case they want to source from multiple vendors.

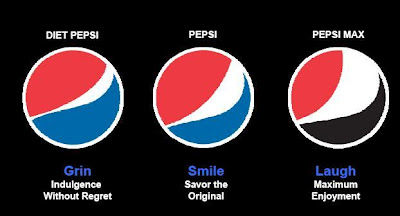

- While private labels account for more than 25% of bottled water sales, they account for less than 15% of retail CSD sales ( I don't know the figures for Walmart). Although private label share of the CSD market is increasing, the national majors (Pepsi, Coke) are fighting back strongly using discounts and promotions. In this scenario, it is unlikely that Walmart will want to change its private label sourcing strategy and experiment with the taste of its products.

Let me know what you think...