The Atlanta Journal-Constitution reported yesterday that customers are increasingly buying private label store brands due to the poor economy (click here). The article quotes research from Nielsen that shows that private label sales grew 10% YTD whereas name brands grew by 3.5% only over the same period.

Earlier research from Nielsen (click here) shows that consumers increasingly think that store brands are a good alternative to name brands and have a comparable quality. Fewer people (24%) think that name brands are worth the extra price. More people now feel that store brands are not only for consumers on a tight budget.

Category managers must ask themselves: Should I discount my name brand to compete against the store private label?

The answer may be different for different product categories and even for different store formats.

The share of private label products varies across categories (click here). It is high for pet food, frozen/refrigerated food and plastic/paper products. It is very low for beverages, home care, baby food, cosmetics, snacks/ confectionery, and hygiene products.

Surprisingly price differentials between private labels and name brands are lowest in categories where the share of private labels is high (around 20%). Price differentials in some categories where store brands have low share are as high as 40%.

This suggests that the price sensitivity and the importance of brand is different in each category. Name brands should use pricing analytics to understand the share and volume impact of various pricing differentials in the specific category.

For some categories (e.g. bottled water), it may make sense for the name brand to focus on low unit-count packs rather than focusing on the bulk-use packs. Consumers who buy bulk-use packs are more likely to be price sensitive.

It is also important to understand that private label receptiveness is much lower in convenience stores than in grocery chains (click here). It is important for category managers to analyze price sensitivity (by share and volume)for their brand for each retail chain separately. Discounting products in a convenience store chain may yield little/ no benefit whereas it may be a good decision at a wholesale chain.

Thursday, December 11, 2008

Wednesday, December 10, 2008

Should Abercrombie discount its wares?

The Wall Street Journal reported earlier this week that Abercrombie & Fitch is pursuing a strategy of not discounting its apparel (fashion brands targeted at young people) during the current recession (click here). The article mentions that their competitors (American Eagle Outfitters, Aeropostale, QuikSilver, Pacific Sunwear) have discounted their apparel significantly.

While competition has seen same-store sales decline by 10-11%, Abercrombie's November same-store sales fell by 28%. However Abercrombie enjoys the highest gross margins (66%) compared to competitors who have much lower margins (AEO:41%; Gap:38%; J Crew:43%, Pacific sunwear:29%). The management insists that discounting will lead to long-term erosion of brand value.

I can't help but ask myself: Should Abercrombie discount its wares?

I think there is a strong case for Abercrombie to consider pricing lower selectively. Here's why:

While competition has seen same-store sales decline by 10-11%, Abercrombie's November same-store sales fell by 28%. However Abercrombie enjoys the highest gross margins (66%) compared to competitors who have much lower margins (AEO:41%; Gap:38%; J Crew:43%, Pacific sunwear:29%). The management insists that discounting will lead to long-term erosion of brand value.

I can't help but ask myself: Should Abercrombie discount its wares?

I think there is a strong case for Abercrombie to consider pricing lower selectively. Here's why:

- Abercrombie's target population has been hit hard by the recession due to potentially reduced pocket money from parents (for younger teens) to bleaker job prospects (for recent graduates) to higher tuitions and costlier student loans (for college students). Clearly, the target customers will cut back on apparel spending, especially on premium brands.

- Abercrombie has a 66% gross margin (Yep, you read that right: their average cost of goods sold is only a third of the average price). However its fixed costs (marketing and distribution expenses) run to more than $450 MM per quarter (~54% of sales in the Nov'08 quarter). This is much higher than the comparables for most competitors.

- Assuming that marketing and distribution costs remain largely fixed, Abercrombie will make a loss if its sales decline a further 15% from Nov'08 quarter levels.

- Based on current sales and inventory numbers, Abercrombie is carrying more than 50 days of inventory. This is a fairly high level in Abercrombie's history. Inventory pile-up could force it to discount later(as winter-wear will need to be sold off before spring).

- Although there is a strong case for brand equity dilution, Abercrombie could consider structuring the discount selectively on products that are slow-moving. Also it can be relatively discreet about its discounts so that it does not impact brand image.

Advertising in a recession economy

Most ad agencies and marketers are expecting a significant reduction(4-6%) in US ad spending in 2009 after being flat/ slightly down in 2008 (click here for Dec 8 Bloomberg article). McClatchy, a leading US newspaper company, reported a 17% decline in ad revenues for the first 10 months of 2008 (click here). Most experts are anticipating at least 5% growth in internet spending and more than 5% decline in magazine and TV ads.

I personally think the 2009 number could be closer to the lower end of expectations. Let me explain. Advertising Age has tracked US ad spend for the top 100 marketers in a report called Marketer Trees 2008. The split of the $105 BN spent by the top 100 marketers shows that financial services and automotive were key spenders (22% of total). These industries have been badly hit by the recession and can reasonably be expected to cut advertising spend significantly.

Other key sectors such as Drugs, Retail,Personal care, and Telecom (specifically mobile) are also experiencing slow down and are likely to slow their spending. One of the biggest spenders, P&G, has reduced its ad spending by 6% YTD till September 2008. As such I think ad spending is likely to reduce significantly

Other key sectors such as Drugs, Retail,Personal care, and Telecom (specifically mobile) are also experiencing slow down and are likely to slow their spending. One of the biggest spenders, P&G, has reduced its ad spending by 6% YTD till September 2008. As such I think ad spending is likely to reduce significantly

Another interesting angle is that of ad spends as a percentage of sales. Many top consumer brands currently spend more than 10% of US sales on US advertising. These companies will surely see the need to cut advertising spends and use the savings to reduce pricing during the recession.

Brand marketers are facing a vexing problem: How should we change advertising spends and media mix in the recession economy, without reducing communication to the consumer? Can we rely on historical RoI data and historical Media Mix models in a rapidly changing marketplace?

Here are my thoughts:

I personally think the 2009 number could be closer to the lower end of expectations. Let me explain. Advertising Age has tracked US ad spend for the top 100 marketers in a report called Marketer Trees 2008. The split of the $105 BN spent by the top 100 marketers shows that financial services and automotive were key spenders (22% of total). These industries have been badly hit by the recession and can reasonably be expected to cut advertising spend significantly.

Other key sectors such as Drugs, Retail,Personal care, and Telecom (specifically mobile) are also experiencing slow down and are likely to slow their spending. One of the biggest spenders, P&G, has reduced its ad spending by 6% YTD till September 2008. As such I think ad spending is likely to reduce significantly

Other key sectors such as Drugs, Retail,Personal care, and Telecom (specifically mobile) are also experiencing slow down and are likely to slow their spending. One of the biggest spenders, P&G, has reduced its ad spending by 6% YTD till September 2008. As such I think ad spending is likely to reduce significantlyAnother interesting angle is that of ad spends as a percentage of sales. Many top consumer brands currently spend more than 10% of US sales on US advertising. These companies will surely see the need to cut advertising spends and use the savings to reduce pricing during the recession.

Brand marketers are facing a vexing problem: How should we change advertising spends and media mix in the recession economy, without reducing communication to the consumer? Can we rely on historical RoI data and historical Media Mix models in a rapidly changing marketplace?

Here are my thoughts:

- Many marketers will be able to reduce media spending significantly without reducing brand exposure and communication due to falling ad rates (for TV ads, newspapers, magazines). Online advertising rates are also falling (click here for article).

- Marketers need to seriously assess the need to reduce brand exposure (Rating points, online clicks, etc) based on continuous monitoring of the competition. Any sudden changes in 'share of voice' could have adverse impact on market share.

- Although internet advertising had immediate and measurable impact on brand communication (and sales), marketers should not underestimate the long-term impact of traditional media (TV, magazines). Any dramatic reductions in brand exposure through traditional media could have adverse long term impact.

- Analytical models (media mix models, media RoI models) based on historical data need to be relooked based on the changing circumstances. RoI measures need to broken down into 'sales impact per rating point' and 'price per rating point'. The new media pricing for 2009 can be factored into the analysis to re-adjust RoI estimates for 2009.

Sunday, December 7, 2008

How big is Green computing?

If you've seen the TV ads being run by IBM lately, the theme seems to be 'green'. This is quite a dramatic shift in focus of their marketing message from 'innovation' to 'green business'.

This makes me wonder: "How big is green computing? How can a technology company identify (and target) businesses that are more green than others?"

How big is green computing?

According to a Feb 2007 report by Dr Jonathan Koomey, commissioned by AMD (click here): "In 2005, the electrical bills for U.S. companies totaled $2.7 billion. The cost of electricity for the entire world topped $7 billion. Within the United States, the total cost of powering data center servers represented about 0.6 percent of total electrical use within the country. When the additional costs of cooling and other usage is factored in, that number jumps to 1.2 percent."

An August 2007 report by the US Environmental Protection Agency (EPA) states that: "The energy used by the nation’s servers and data centers is significant. It is estimated that this sector consumed about 61 billion kilowatt-hours (kWh) in 2006 (1.5 percent of total U.S. electricity consumption) for a total electricity cost of about $4.5 billion. .... Federal servers and data centers alone account for approximately 6 billion kWh (10 percent) of this electricity use, for a total electricity cost of about $450 million annually."

Based on these reports, one can say that energy consumption in US data centers is between 1.2% to 1.5% of total US electricity consumption.

Quick analytics quiz: How much should US companies be willing to spend (on a purely economic basis) for technologies that could save 25% (EPA estimate) of the $4.5 BN spent on data center energy? Assuming a 5 year payoff, and assuming a doubling of data center energy costs in 5 years, the number is around $10 BN (over the next few years).

This is surely a large number, but hardly a number that would get IBM, HP and Dell excited. So what's the logic behind IBM's excitement.

The real story is virtualization and consolidation. Currently a lot of data centers use old servers (10-15 yrs old) running at capacity utilization less than 15% (click here for details). IBM quotes the case of PG& E. PG&E consolidated nearly 300 UNIX servers onto 6 IBM System p5 servers, helping to reduce 80 percent of its energy and facilities consumption, and used IBM virtualization technologies to boost utilization of the systems from 10 percent capacity to over 80 percent. More importantly, virtualization and consolidation drive savings in employee costs, maintenance costs and rent, in addition to energy costs.

According to a discussion that Bob Moffat and Rod Atkins (senior executives of IBM's Systems & Technology Group (S&TG)) had with analysts in late September 2008, virtualization and consolidation have driven S&TG's growth in 2008. " In the second quarter, these efforts resulted in approximately 30% year-to-year

growth in both mainframes (System z) and converged System p. Mainframes have been fully virtualized since the 1960s and, in second quarter, over 60% of POWER servers were virtualized – up nearly three-fold from the same period in 2007".

' Green business' is a good corporate marketing concept that couches the real economic impact of virtualization & consolidation in a context (enviromental responsibility) that is very relevant for the boards of Fortune 500 companies. Lower energy consumption is a side-effect of virtualization & consolidation, but is clearly more palatable to C-level executives.

How can a technology company identify (and target) businesses that are more green than others?

Since green is a side-effect of virtualization and consolidation, technology companies should identify businesses that will benefit most from it. These businesses have the following characteristics:

Meanwhile I am wondering about an associated issue: What is the environmental impact of disposing 300 old servers and installing 6 new servers? Is that 'green business'? ;-)

This makes me wonder: "How big is green computing? How can a technology company identify (and target) businesses that are more green than others?"

How big is green computing?

According to a Feb 2007 report by Dr Jonathan Koomey, commissioned by AMD (click here): "In 2005, the electrical bills for U.S. companies totaled $2.7 billion. The cost of electricity for the entire world topped $7 billion. Within the United States, the total cost of powering data center servers represented about 0.6 percent of total electrical use within the country. When the additional costs of cooling and other usage is factored in, that number jumps to 1.2 percent."

An August 2007 report by the US Environmental Protection Agency (EPA) states that: "The energy used by the nation’s servers and data centers is significant. It is estimated that this sector consumed about 61 billion kilowatt-hours (kWh) in 2006 (1.5 percent of total U.S. electricity consumption) for a total electricity cost of about $4.5 billion. .... Federal servers and data centers alone account for approximately 6 billion kWh (10 percent) of this electricity use, for a total electricity cost of about $450 million annually."

Based on these reports, one can say that energy consumption in US data centers is between 1.2% to 1.5% of total US electricity consumption.

Quick analytics quiz: How much should US companies be willing to spend (on a purely economic basis) for technologies that could save 25% (EPA estimate) of the $4.5 BN spent on data center energy? Assuming a 5 year payoff, and assuming a doubling of data center energy costs in 5 years, the number is around $10 BN (over the next few years).

This is surely a large number, but hardly a number that would get IBM, HP and Dell excited. So what's the logic behind IBM's excitement.

The real story is virtualization and consolidation. Currently a lot of data centers use old servers (10-15 yrs old) running at capacity utilization less than 15% (click here for details). IBM quotes the case of PG& E. PG&E consolidated nearly 300 UNIX servers onto 6 IBM System p5 servers, helping to reduce 80 percent of its energy and facilities consumption, and used IBM virtualization technologies to boost utilization of the systems from 10 percent capacity to over 80 percent. More importantly, virtualization and consolidation drive savings in employee costs, maintenance costs and rent, in addition to energy costs.

According to a discussion that Bob Moffat and Rod Atkins (senior executives of IBM's Systems & Technology Group (S&TG)) had with analysts in late September 2008, virtualization and consolidation have driven S&TG's growth in 2008. " In the second quarter, these efforts resulted in approximately 30% year-to-year

growth in both mainframes (System z) and converged System p. Mainframes have been fully virtualized since the 1960s and, in second quarter, over 60% of POWER servers were virtualized – up nearly three-fold from the same period in 2007".

' Green business' is a good corporate marketing concept that couches the real economic impact of virtualization & consolidation in a context (enviromental responsibility) that is very relevant for the boards of Fortune 500 companies. Lower energy consumption is a side-effect of virtualization & consolidation, but is clearly more palatable to C-level executives.

How can a technology company identify (and target) businesses that are more green than others?

Since green is a side-effect of virtualization and consolidation, technology companies should identify businesses that will benefit most from it. These businesses have the following characteristics:

- Old servers (more than 10 years old) in their data centers

- Lack of virtualized machines used by the business

- Businesses that have large data centers with significant energy costs (and facilities, employee costs)

- Servers with low capacity utilization

Meanwhile I am wondering about an associated issue: What is the environmental impact of disposing 300 old servers and installing 6 new servers? Is that 'green business'? ;-)

Wednesday, December 3, 2008

Layaway: Sound recession strategy or outdated retail gimmick?

The Washington Post reported this weekend that layaway programs are back at retailers like KMart and Sears (click here for article) . Click here to get the KMart layaway program details.

In a layaway, shoppers put a small down payment on merchandise and pay a service charge of roughly $5 to $10. Shoppers must return every few weeks for 2-3 months to make payments until the merchandise is paid off. Only then can they take their prized possession home.

Such programs were popular during the Great recession but have been discontinued by most retailers in the past few decades.

I can't help but ask: Is the layaway program a sound recession marketing strategy or is it an outdated retail gimmick?

Here's what's working for layaway this season:

Store chains should be careful not to use layaway as a technique to make easy money from cash-strapped customers (e.g., They should offer extensions to customers who are late on their last payment). They will likely lose customers who lose their holiday presents to a missed payment.

In a layaway, shoppers put a small down payment on merchandise and pay a service charge of roughly $5 to $10. Shoppers must return every few weeks for 2-3 months to make payments until the merchandise is paid off. Only then can they take their prized possession home.

Such programs were popular during the Great recession but have been discontinued by most retailers in the past few decades.

I can't help but ask: Is the layaway program a sound recession marketing strategy or is it an outdated retail gimmick?

Here's what's working for layaway this season:

- As is pointed out in the article, the fees for the layaway program are much lower than credit card late payment fees.

- It forces people to budget for items they truly want to buy. Even Oprah Winfrey mentioned it on her TV show.

- It requires people to have the financial and mental discipline to buy what they can afford and wait for a few months to get it. This would be especially difficult for people who have not maxed out their credit limits.

- Customers who lose merchandise because they could not make a payment in time will be disillusioned and may not use it next year.

- Customers who make layaway payments using credit cards could be pushed further into debt.

Store chains should be careful not to use layaway as a technique to make easy money from cash-strapped customers (e.g., They should offer extensions to customers who are late on their last payment). They will likely lose customers who lose their holiday presents to a missed payment.

Tuesday, December 2, 2008

...brick-and-mortar book stores ...: Part 3 -- brick&mortar advantage

As I had discussed in Part 1, Barnes & Noble and Borders need to consider three initiatives to compete against Amazon (in addition to shutting down unprofitable retail stores and reducing employee count):

- Create a more credible online option to compete against Amazon

- Use brick-and-mortar as a competitive advantage

- Align inventory to demand

- Offer the option to buy online and pickup/deliver from a store : This is a feature that BN and Borders can uniquely offer, which Amazon cannot replicate. BN and Borders currently offer free pickup at stores. This needs to be promoted much more (while they still have many stores within driving distance of most of the US population). BN and Borders should also consider using their book stores as local delivery hubs to dramatically reduce their courier costs.

- Better organize in-store book discussions/signings/ reading sessions: While both BN and Borders organize in-store events, i believe they do not use their facilities to the maximum. Borders does not promote in-store events on their website. Although BN does promote events on their website, they do not have a mailing list for events. Store associates should be encouraged to promote events and signing up to the event mailing list. BN and Borders could leverage their loyal customer base by allowing customer groups to 'self-organize' reading sessions at the stores, especially for children. Create a whole new group of 'book moms' among the loyal customers. Amazon admits it cannot compete with BN and Borders on in-store events !

- Offer bundled offers in the store: Amazon scores over BN and Borders by offering deals on bundles of products based on prior transaction history. This is done using an analytical technique called Market basket analysis. There is no reason why BN and Borders cannot offer bundled deals in the store and online.

- Install digital displays in the store showing reader reviews and suggesting complementary reading recommendations: Take collaborative filtering to the brick-and-mortar world by installing digital displays or dumb interactive terminals showing reviews for books in an aisle and recommending complementary books based on collaborative filtering. The CF algorithm should not be limited to the online sales data of BN/ Borders but should include offline sales also.

- Here's an outrageous marketing suggestion: pilot a reading room service. For too long many visitors to book stores have been using them as free reading rooms. They would not mind paying a few dollars an hour for a comfortable reading room.

- Better align inventory to demand

- Use statistical models based on demographic profiles of store localities and historical 'comparable' title sales to better allocate new title inventory to stores. I bet that the sales of books related to hunting and the outdoors sell much more in the countryside and that sales of financial and management books are higher in urban areas.

- Dynamically trans-ship best-seller inventory between stores based on matching with demand patterns. This is done routinely for new DVD sales on a daily basis by Warner and Universal. It is noteworthy that most demand for new best-sellers occurs in the first week after release!

- Since BN carries more than 4 months of inventory and Borders carries more than 5 months of inventory, I can't help thinking that they need to do better at demand forecasting even for mature titles. They should consider panel regression techniques which consider store characteristics, locality demographics and product characteristics (genre, author, rating, time since release, price, etc).

Monday, December 1, 2008

...brick-and-mortar book stores ...: Part 2 -- The online store

As I had discussed in Part 1, Barnes & Noble and Borders need to consider three initiatives to compete against Amazon (in addition to shutting down unprofitable retail stores and reducing employee count):

- Create a more credible online option to compete against Amazon

- Use brick-and-mortar as a competitive advantage

- Align inventory to demand

- Collaborative filtering: CF algorithms produce personal recommendations by computing the similarity between your preference and that of other people. Amazon produces CF recommendations for the search history and the purchases of a user. Borders.com does not have CF recommendations whereas BN.com has CF recommendations for items in the shopping cart only. Some unique things about Amazon.com:

- It tracks the IP address/ cookie on the computer so that a user revisiting a site instantly gets recommendations based on previous searches on the site

- Amazon suggests what people buy after viewing a certain item. This is called sequence analysis.

- It offers auto-fill for search words when a user types a search item e.g., typing "snowball" offers "snowball warren buffett" as the first auto-fill option

- Pricing of online offers: I compared the prices on a couple of bestsellers and a couple of new releases.

- The pricing on Amazon is lower than that of bn.com by 5% (for BN members). The BN membership price is usually lower than the Borders.com price. In this competitive business, it goes without saying that bn.com and borders.com need to lower prices.

- Also an often overlooked aspect is the presentation of 'used' book prices alongside new book prices. By doing that Amazon caters to the price-sensitive user who doesn't mind buying used books.

- Wider variety of offerings: Amazon.com has a wider variety of offerings especially for long tail titles among technical books (a simple check for SAS textbooks yielded 121 results on bn.com and 9272 results on Amazon.com) and for children's books ("Elmo" yields 492 titles on bn.com and 13,985 titles on Amazon).

- Online used books strategy: Clearly a part of Amazon's variety advantage is its role as an exchange of used books.BN buys used books and sells it themselves. This could be a risky strategy and may not be attractive to sellers either. BN also has an authorized seller program, which is attractive for large volume sellers. Borders has an alliance with Alibris for used books. However Borders 'Marketplace' has a separate sign-on and is not integrated with Borders.com, which is a bummer. (also sellers having to pay more to sell on Borders.com than on alibris.com, which is clearly a hindrance). Amazon's fee structure is much lower than that of Alibris for small volume sellers (<40 items). BN and Borders should take a Go/ No-Go decision based on profitability.

Sunday, November 30, 2008

How can brick-and-mortar book stores compete?: Part 1

Last week, Borders and Barnes & Noble declared their third quarter results. Both companies reported a net loss at an operating level. Both companies are shutting some unprofitable book stores and trying to rein in costs to become profitable.

I am a big fan of both Borders and Barnes & Noble, and cannot help thinking: How can these companies use analytics to survive the onslaught of Amazon.com?

I analyzed the Q3 numbers of B&N, Borders and Amazon, and here's what I found:

I am a big fan of both Borders and Barnes & Noble, and cannot help thinking: How can these companies use analytics to survive the onslaught of Amazon.com?

I analyzed the Q3 numbers of B&N, Borders and Amazon, and here's what I found:

- Online sales account for less than 10% of Barnes & Noble sales and less than 2% of Borders' sales. Of course they account for 100% of Amazon.com's sales.

- Amazon is growing much faster than B&N and Borders. In Q3, these companies had comparable sales growth of 19%, -6% and -12% respectively. Note that Amazon numbers are for Media sales (Books, DVD, music). Amazon Media sales for international markets grew faster at 24% compared to US sales at 15%.

- Amazon runs an operating profit whereas its competitors run a loss. The key difference is in SG&A cost and depreciation. Surprisingly B&N has a lower COGS (cost of goods sold) than Amazon.

Amazon has a higher operating margin in its international operations. Borders has a higher operating loss margin in small-format Walden US stores (-14.4%) and a lower operating loss margin in international stores (-5.3%).

Amazon has a higher operating margin in its international operations. Borders has a higher operating loss margin in small-format Walden US stores (-14.4%) and a lower operating loss margin in international stores (-5.3%). - A large format book retail store requires sales of $20 per sq.ft per month to turn an operational profit. B&N is currently registering $18 per sq.ft per month and Borders US is selling only $14 per sq ft per month in its large stores. A Walden's (small format) store requires sales of more than $30 per sq. ft per month to have an operational profit. Currently Walden's US has sales of $17 per sq ft per month only. Thus there is an urgent need to increase sales per sq ft

- Amazon has much lower inventory than B&N and Borders (as shown below).

Borders is carrying more than 5 months of inventory whereas B&N is carrying more than 4 months of inventory. I feel that book stores need to better align inventory with demand.

Borders is carrying more than 5 months of inventory whereas B&N is carrying more than 4 months of inventory. I feel that book stores need to better align inventory with demand.

- B&N and Borders need to create a more credible online option to compete against Amazon.

- I recommend usage of collaborative filtering to offer instant book recommendations to online buyers. Also bn.com and borders.com can improve in terms of linking past browsing behavior to book recommendations online

- Barnes & Noble needs to consider matching amazon.com on pricing (given it's lower Cost of Goods). E.g., I recently found that the Buffett biography : The Snowball is priced at least 5% lower on Amazon.com

- Many customers feel that Amazon has a wider selection of technical and children's books titles than other online book stores. Catering to the long tail may be essential to competing with Amazon.

- Use brick-and-mortar as a competitive advantage:

- Offer the option to buy online and pickup at a store within a few hours

- Let loyal book buyers work for you by organizing 'low-cost' book discussions/reading sessions especially for children, niche interest segments

- Offer bundled offers in the store, based on basket analysis of previous purchases

- Consider installing digital displays in the store showing reader reviews and suggesting complementary reading recommendations (based on collaborative filtering).

- Align inventory to demand

- Use statistical models based on demographic profiles of localities and historical title sales to better allocate inventory to stores.

- Dynamically trans-ship best-seller inventory between stores based on matching with demand patterns (since most demand for best-sellers occurs in the first week after release)

Thursday, November 27, 2008

My thoughts on Nielsen's "Top 10 Retailer Mistakes on Black Friday"

Nielsen published an article earlier this week on "Top 10 Retailer Mistakes on Black Friday".

According to Nielsen, the mistakes include:

According to Nielsen, the mistakes include:

- Sticking to traditional categories

- Not having a retailing objective

- Not measuring your objectives

- Leaving a bad first impression with new shoppers

- Missing loyalty opportunities

- Sticking to Friday morning

- Not having door-buster merchandise in stock

- No sense of urgency

- Shallow discounts on door-busters

- Not scouting the competition

- It may be a bad idea for retailers to try out new categories. I think it is OK for an electronics retailer to offer free soda and chips during Black Friday, but selling these items is a very different proposition.

- Most retailers do have sales objectives (by category) for Black Friday. I think what they also need to have are gross margin objectives. Given the hectic pace of Black Friday, it is often not possible to have targets for 'new customer footfalls'.

- Retailers need to be careful about passing discounts to the most loyal customers. Many of them are willing to shop with the retailer without the discount. On the other hand, many Black Friday shoppers are active discount seekers.

Wednesday, November 26, 2008

The brand new face(s) of Pepsi ;-)

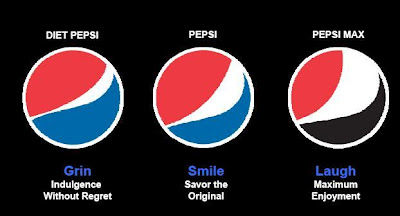

Pepsi announced that it is rejigging its brands at the Morgan Stanley Global consumer & retail conference last week. The key elements of the brand redesign and repositioning are:

Pepsi announced that it is rejigging its brands at the Morgan Stanley Global consumer & retail conference last week. The key elements of the brand redesign and repositioning are:- New logos for all the Pepsi beverage brands which supposedly leverage Pepsi's design heritage, humanity, and simplicity. The logo re-design efforts are being led by Arnell Group (the same agency that re-branded Reebok as Rbk, and Donna Karan as DKNY).

- Clear sub-segmentation of the hydration 'need state' into simple hydration (Aquafina), body wellness (Propel, SoBe), and performance hydration (G2, Gatorade). Pepsi seeks to expand ('democratize') the brand appeal of Gatorade from athletes to exercisers.

- Repositioning of Tropicana for the breakfast occasion and Trop50 for calorie-conscious consumers

- Targeting of Lipton and Tazo RTD teas at specific demographic and need sub-subsegments within the Nourish need state

- Launching hybrids of the energy drink AMP (with tea, lemon) to incorporate consumer feedback of unfamiliar taste and lack of thirst-quenching in the Transform need state

Some of the products launched by Pepsi recently are very notable (Diet Pepsi Max, flavored AMP variants). As a traditional Diet Coke fan, I was surprisingly attracted to the taste of Diet Pepsi Max. I personally witnessed a free sample promotion for Diet Pepsi Max outside Grand Central station in NYC in mid-October and the reviews appeared good. Pepsi has opened up a new segment in the CSD market by adding ginseng to cola. This will attract consumers who want a rush of energy with few calories at a price point below energy drinks.

The ball is now in Coca Cola's court...

Wednesday, November 19, 2008

Black Friday deals: Do they work for the retailer?

The US holiday retail season this year is expected to be the worst in the past few decades. Many retailers have started offering Black Friday discounts in advance.

The website Black Friday Ads tracks some of the hottest discount deals being offered by retailers. They have a page which tracks the scanned advertisements of most big US retailers. Some retailers are offering online deals at prices below Black Friday prices.

I couldn't help wondering how retailers can use analytics to maximize their Black Friday sales and gross margins. Here are some suggestions :

This season, retailers may have to resort to a long period of discounting with dynamic moves based on competition and sales performance on a daily basis. Getting the process of discount pricing will be very critical.

The website Black Friday Ads tracks some of the hottest discount deals being offered by retailers. They have a page which tracks the scanned advertisements of most big US retailers. Some retailers are offering online deals at prices below Black Friday prices.

I couldn't help wondering how retailers can use analytics to maximize their Black Friday sales and gross margins. Here are some suggestions :

- Designing the black friday deals:

- Analyze market surveys to understand what products people want to buy during Black friday (computers, HD TVs, iPods, hard disk drives, digital cameras, GPS devices, clothes, toys) this year

- Benchmark prices against competition based on information available daily to ensure that you have enough traffic-pullers...these get the people into the stores.

- Ensure that your deals are spread across the aisles/ departments. This ensures that customers are exposed to more categories whil picking up the doorbuster items and that all doorbuster products are not picked up just by the first few customers. An analysis of previous years' transaction data will yield numbers on how many customers got a doorbuster product (typically a few hundred per store) and how each of these customers moved through the aisles.

- After Black Friday: Analyze the baskets of transactions during Black Friday:

- Customers who buy doorbuster products often pick up other items that may not have significant discount. Calculate the sales and gross margin on baskets that have a doorbuster product. Retailers often lose money on the first customers in line.

- Customers often come in after the doorbuster products are sold (Each store usually stocks 5-15 units of each doorbuster). They often pick up products with lower discounts. To calculate the halo effect of the discount, calculate the sales and gross margin lift for Black Friday baskets without a doorbuster product

- So long as the total of the above has positive sales and margin impact, the retailer made money on the Black Friday deals.

- The learning from Black Friday can be used to better structure deals for the rest of the holiday season.

This season, retailers may have to resort to a long period of discounting with dynamic moves based on competition and sales performance on a daily basis. Getting the process of discount pricing will be very critical.

About this blog

This is my first blog post. So I wanted to write about what this blog is going to be about. Hopefully this helps you decide whether to subscribe to this blog or not.

This blog will attempt to highlight how companies can make smarter business decisions using analytics (which I define as the 'collation, summarization, mining and analysis of data').

Why this blog?

Most companies generate and collect a lot of data in their business...but don't use this data enough while making business decisions. (This may sound cliched but it is true!). My hypotheses on why this happens are:

What industries will this blog cover?

This blog will initially focus on business problems in the retail, consumer goods, telecoms, banking and insurance industries (because I am most interested in these industries). Of course, I will include business issues from other industries if I find them interesting and if I feel I am competent enough to write about them.

What kind of business problems will this blog discuss?

I plan to write about a wide variety of business problems ranging from marketing, merchandising to operations (supply chain, logistics) to fraud detection.

Of course, I welcome comments on what topics readers would like to discuss in the blog.

This blog will attempt to highlight how companies can make smarter business decisions using analytics (which I define as the 'collation, summarization, mining and analysis of data').

Why this blog?

Most companies generate and collect a lot of data in their business...but don't use this data enough while making business decisions. (This may sound cliched but it is true!). My hypotheses on why this happens are:

- Data is stored across functional and divisional silos across the company. E.g., Surveys done by the marketing team may not be available to the customer service team

- It requires a lot of effort to clean and update data required for analysis. Corporate IT is often short of resources for maintaining analytical databases. E.g., Many B2B companies don't have a single view of a customer across all their internal and third-party databases

- Analysis often requires ad-hoc queries of complex databases. Companies don't have enough skilled resources to query these databases

- Some advanced analysis techniques require significant expertise (statistics, operations research, etc), computing power and time. Some managers believe it is important to take half-correct decisions quickly rather than better decisions with more time.

What industries will this blog cover?

This blog will initially focus on business problems in the retail, consumer goods, telecoms, banking and insurance industries (because I am most interested in these industries). Of course, I will include business issues from other industries if I find them interesting and if I feel I am competent enough to write about them.

What kind of business problems will this blog discuss?

I plan to write about a wide variety of business problems ranging from marketing, merchandising to operations (supply chain, logistics) to fraud detection.

Of course, I welcome comments on what topics readers would like to discuss in the blog.

Subscribe to:

Posts (Atom)